The goods and service tax (GST) of India has stirred up the whole nation and citizens are ready to face the largest ever tax reform the country is about to see. There are workshops all over the country to educate people about GST and how likely they are going to be affected by it. Some prices of goods and services have been increased while other necessary commodities will have comparatively less or no tax. Here is everything you should know about GST. GST will apply to all states as well as union territories of India. GST is known to be the biggest change in the constitution since independence hopefully rising the economic conditions.

What is GST?

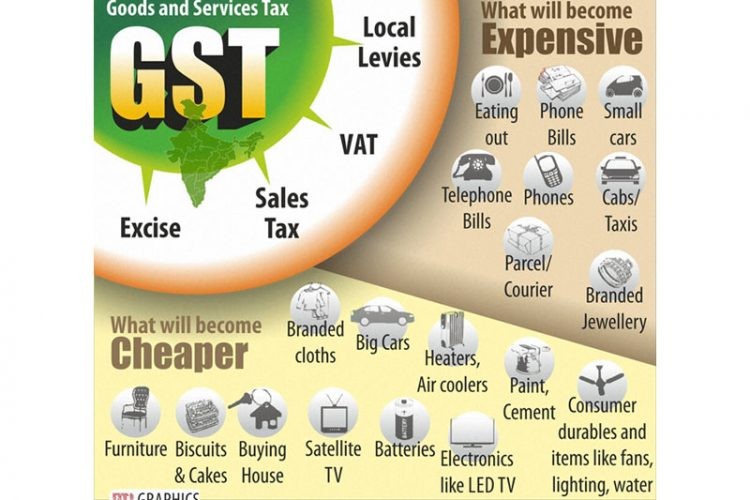

No more you will have a separate service tax, Value Added Tax (VAT), Krishi Kalyan tax, Swachh Bharat tax etc. There were a lot of taxes which was calculated and kept differently from one state to another. Even if you want to transfer goods from one state to another you end up paying a lot of taxes in each state you pass by thereby increasing your charges enormously. Now, it is all combined and given the name of one single tax- goods and service tax and will hopefully make all your calculations easier.

What taxes will be covered by GST?

GST will cover the following taxes:

- Central Excise Duty

- Service Tax

- Commercial Tax

- Value Added Tax (VAT)

- Food Tax

- Central Sales Tax (CST)

- Octroi

- Entertainment Tax

- Entry Tax

- Purchase Tax

- Luxury Tax

- Advertisement taxes

- Taxes applicable on lotteries

How to calculate GST?

Suppose the manufacturing cost for a product is INR 100. Let’s assume the GST is 20%. Thus the price at now is INR 120. Now he decides to sell the product at INR 160. There is a difference of INR 40. GST will now be applicable on the difference amount i.e. INR 40. GST will thus be 20% of INR 40 i.e. INR 8. So the final price of the product is INR 168.

INR 100 + 20% of INR 100 (20) + profit (40) + 20% of profit amount (8) = INR 168

Everything about GST

The tax rate slabs for the goods and services range from 0% to 28%. The four slabs as decided by the council are 5%, 12%, 18% and 28%. The daily commodities will attract a 5% tax whereas luxury items will have 28% tax.

The most commonly used items will have either no tax or 5% tax. Bulk items and services above INR 1000 will attract a 12% or 18% tax. Luxury items will likely to have the highest slab of 28% tax.

Tobacco and aerated products will have 28% tax in order to control the use of it. These will also have an extra cess above 28% for the first five years. Moreover, this cess will contribute towards the improving clean energy for the state. The cess is lapsable after 5 years.

There is a difference between C-GST, S-GST, and I-GST. This is to avoid collecting taxes double times from central government as well state government. The central government will collect C-GST while the state government will collect S-GST. Integrated GST or I-GST will apply on goods transferred from one state to another.

Costly or cheap?

Following are few of the items that are most likely to become expensive:

- Cigarettes

- Aerated drinks

- Restaurants

- Telephone bills

- Banking

- Railway tickets

- Cabs/ taxis

- Home appliances

Following are few items that are likely to get cheaper:

- Economy class flight tickets

- Two wheelers

- Medicines

- Movie tickets

- Personal care products

GST demands an amendment to the constitution. Thereby the bill took a long time to pass in both the houses and get its approval. It requires two-thirds of the votes in both Lok Sabha and Rajya Sabha as well as requires the president’s approval. It has been proposed since Dr. Manmohan Singh was in power. The initial GST implementation date was of 1st April 2017 but government fell behind its schedule and it’s finally rolling out after three months. Hence, that is all about the history of GST bill.

What is debatable in GST?

The sale of liquor is the most debatable topic and how increasing the price will affect will affect the economy of the country. Sale of alcohol will thereby take a hit as it is tagged as sin product. The tax is the highest slab along with tobacco. Alcohol is a major revenue generator for many states. Moreover, increased price will definitely reduce the consumption which will help people but at the cost of economic growth.

So with our fingers crossed we sincerely hope GST will be fruitful for the economy of the country as well as its people.

Leave a Reply