[toc]

If required, you can make a change in PAN Card data. You can make a change in name, parents’ name, address, date of birth, gender, photograph and signature. The process of making a change/correction is very similar to the process of applying for a PAN Card.

Follow these simple steps to make a change in PAN Card data:

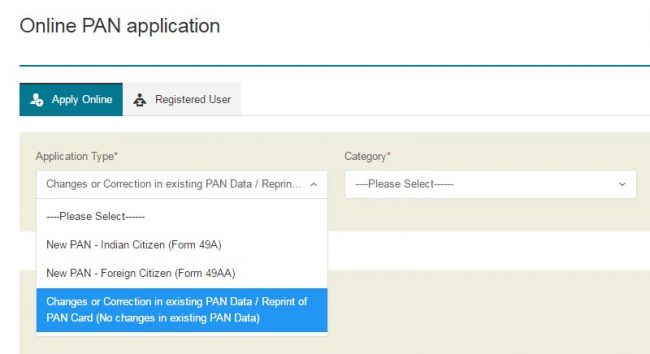

Step 1: Fill up the application form on the official NSDL website.

- Log onto https://www.tin-nsdl.com/pan/pan-index.php

- Click ‘Apply’ under the section ‘Change/Correction in PAN Data’.

- Fill up the basic online PAN application form like the one shown below.

- Under application type, pick the third option – ‘Changes or Correction in Existing PAN Data/Reprint of PAN Card (No changes in existing PAN Data)’

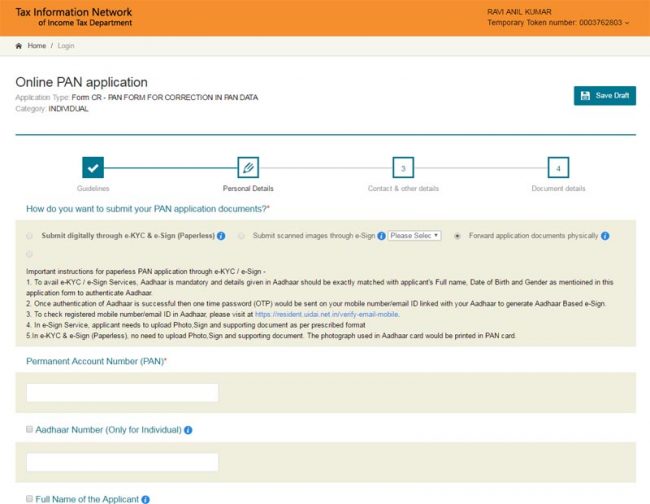

Step 2: Fill PAN Change Request Form online.

- Fill Form CR – PAN FORM FOR CORRECTION IN PAN DATA

- Fill up all the mandatory fields, and select the corresponding box on the left margin of whichever fields have a change.

- Read these instructions carefully before filling the form.

- After filling in the details, a confirmation screen will be displayed. If needed, edit it. Or confirm it.

Note – In this form, you can select any of the following three options –

- Submit digitally through e-KYC and e-Sign (Paperless)

- Submit scanned images through e-Sign

- Forward application documents physically

Step 3: Payment for Change in PAN Card Data.

- The processing fee for those residing in India is Rs. 107, and for those residing outside India is Rs.994.

- Payment can be made via Credit Card/Debit Card, Net Banking or Demand Draft.

- The Demand Draft should be in favour of ‘NSDL – PAN’ payable at Mumbai.

- In case of online payment – Save and print the payment acknowledgement after successful online payment.

- For those residing outside India, the dispatch facility is available for these selected countries. People residing in any other country need to contact NSDL directly.

- Click here to check the status of online payment or regenerate acknowledgement receipt.

Step 4: Save and Print the Acknowledgement.

- An acknowledgement screen will be displayed after confirmation.

- It contains a 15 digit unique acknowledgement number as well as your details, and space to affix your photographs and sign.

- This acknowledgement also indicates the fields marked for change.

- Save and print this acknowledgement.

Step 5: Affix photographs and Sign the Acknowledgement.

- For ‘Submit digitally through e-KYC and e-Sign (Paperless)’ – The photograph from your Aadhaar Card will be used on your PAN Card.

- For ‘Submit scanned images through e-Sign‘ – You have to upload scanned images of your photograph, sign and Aadhaar Card.

- For ‘Forward application documents physically‘ –

-

- On the printed acknowledgement, space for photographs and signature will be provided.

- Affix two recent colour photographs of size 3.5 cm by 2.5 cm.

- Do not staple or clip the photos as that might affect the clarity of the photos.

- Sign across the photo affixed on the left side. And make sure a portion of the signature is on the photo and a portion on the page.

- Remember – Do not sign across the photo on the right.

- Sign in the box given for signature.

- In case of thumb impression, attestation by a Magistrate or a Notary Public or a Gazetted officer is needed.

Step 6: Submit Documents for Change in PAN Card.

- Send the acknowledgement form (with photographs and signature) to NSDL at ‘Income Tax PAN Services Unit, NSDL e-Governance Infrastructure Limited, 5th Floor, Mantri Sterling, Plot No. 341, Survey No. 997/8,Model Colony, Near Deep Bungalow Chowk, Pune – 411 016′.

- Attach the following – Proof of existing PAN Card, proof for change requested, Demand Draft or online payment acknowledgement, proof of identity, proof of address, proof of date of birth.

- See the complete list of documents here.

- Attach a copy of Aadhaar allotment letter if Aadhaar is mentioned in the application.

- Superscribe ‘APPLICATION FOR PAN CHANGE REQUEST — N-15 digit Acknowledgement Number’ on the envelope.

- All of this has to reach NSDL within 15 days of making the online application.

- To check the status of your application, sms NSDLPAN < space > 15 digit Acknowledgement No. and send to 57575.

Contact Details:

You can contact NSDL for further information –

PAN/TDS Call Centre – 020 – 27218080

E-mail – [email protected]

Address – INCOME TAX PAN SERVICES UNIT, 5th Floor, Mantri Sterling, Plot No. 341, Survey No. 997/8,Model Colony, Near Deep Bungalow Chowk, Pune- 411 016.

Leave a Reply