[toc]

Follow these simple steps to apply PAN Card online:

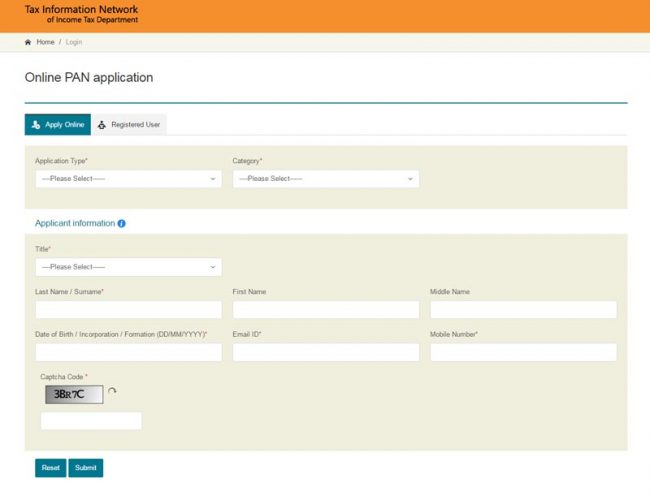

Step 1: Fill up the application form on the official NSDL website to apply PAN card online.

- Log on to https://www.tin-nsdl.com/pan/pan-index.php

- There are separate categories for Indian citizens and foreign citizens.

- Decide which category you fall under and click ‘Apply‘.

- Fill up the basic online application form like the one shown below.

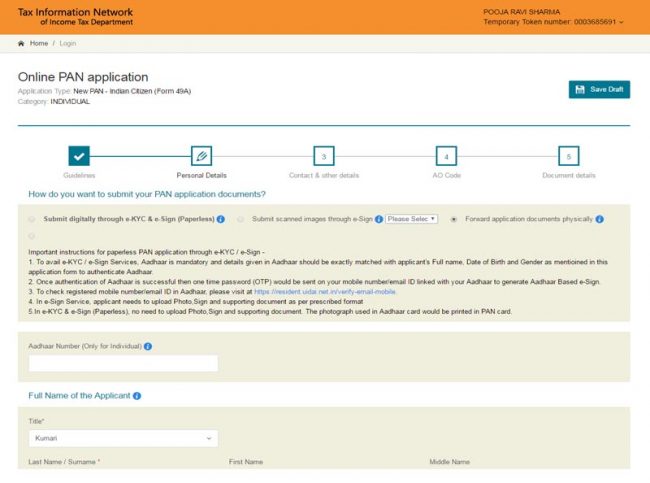

Step 2: Fill Form 49A online.

- Next fill Form 49A. This is for Indian citizens, those located in India as well as outside India.

- This is a very detailed form, so you can refer to these instructions before filling the form.

- You have to select Proof of Identity and Address in this form. Check the complete list of available document options here.

- In this form, you can also opt for Aadhaar based e-signature, where in Aadhaar will be used as a proof of identity, address and date of birth.

- After filling the form, a confirmation screen with the data filled by you will appear. If it’s correct, confirm it. Or you can edit it.

Step 3: Payment for PAN card application.

Processing Fee –

- For people residing within India – Rs.107

- For people residing outside India – Rs.994

You can make the payment in either of these ways –

- Online – Credit Card/Debit Card or Net Banking

- Demand Draft – in favour of ‘NSDL-PAN’ payable at Mumbai

Notes –

- In case of online payment – Save and print the payment acknowledgement after successful online payment.

- For people residing outside India, this facility of dispatch of PAN Card is available for these selected countries. If you are based in any other country, please contact NSDL separately.

Step 4: Save and Print the Acknowledgement.

- An acknowledgement screen will be displayed after confirmation.

- It contains a 15 digit unique acknowledgement number as well as your details, and space to affix your photographs and sign.

- Save and print this acknowledgement.

Step 5: Affix Photographs and Sign the Acknowledgment.

- For ‘Individual’ applicants, space for photographs and signature will be provided in the acknowledgement.

- In the given space, affix two recent colour photographs of size 3.5 cm by 2.5 cm.

- Do not staple or clip the photos as that might affect the clarity of the photos.

- Sign across the photo affixed on the left side. And make sure a portion of the signature is on the photo and a portion on the page.

- Remember – Do not sign across the photo on the right.

- Sign in the box given for signature.

- In case of thumb impression, attestation by a Magistrate or a Notary Public or a Gazetted officer is needed.

Note –

If you have opted for Aadhaar based e-signature, you do not have to affix the photographs and sign on the printed acknowledgement. You have to upload scanned images of your photograph, sign and Aadhaar card. You can also opt to for paperless e-KYC and e-sign, where simply the photograph on your Aadhaar Card will be used on your PAN Card.

Step 6: Documents submission for PAN card

- Send the acknowledgement form (with photographs and signature), Demand Draft or online payment confirmation, proof of identity, address and date of birth to NSDL at ‘Income Tax PAN Services Unit, NSDL e-Governance Infrastructure Limited, 5th Floor, Mantri Sterling, Plot No. 341, Survey No. 997/8,Model Colony, Near Deep Bungalow Chowk, Pune – 411 016′.

- Attach a copy of Aadhaar allotment letter if Aadhaar is mentioned in the application,

- Superscribe ‘APPLICATION FOR PAN — N-15 digit Acknowledgement Number’ on the envelope.

- All of this has to reach NSDL within 15 days of making the online application.

- To check the status of your application, sms NSDLPAN < space > 15 digit Acknowledgement No. and send to 57575.

Contact Details:

You can contact NSDL for further information –

PAN/TDS Call Centre – 020 – 27218080

E-mail – [email protected]

Address – INCOME TAX PAN SERVICES UNIT, 5th Floor, Mantri Sterling, Plot No. 341, Survey No. 997/8,Model Colony, Near Deep Bungalow Chowk, Pune- 411 016.

A PAN Card is a very important document. You need it for filing income tax returns, and most financial and monetary transactions of higher value. It also serves as a proof of identity. So apply for your PAN Card now.

January 19, 2018 8:41 pm

In how many days will i get my pan card if i apply it now?

January 19, 2018 8:41 pm

In how many days will i get my pan card if i apply it now?

February 13, 2018 8:36 am

While living in California outside of India. What should I fill in as Area Code, AO Type, Range Code and AO No. I don’t know what should i fill in these places

February 13, 2018 8:36 am

While living in California outside of India. What should I fill in as Area Code, AO Type, Range Code and AO No. I don’t know what should i fill in these places

July 26, 2018 10:53 pm

can I apply a pan card with aadhaar E-KYC?

July 26, 2018 10:53 pm

can I apply a pan card with aadhaar E-KYC?