Are you facing the problem to withdraw EPF amount.Do you want to withdraw your EPF without any employer signature? Is your previous employer not signing your EPF withdrawal documents? Have you left your jobs and your unable to take your previous employer signatures? Or your employer is not supporting or helping you in this withdraw procedure? Or it might happen that your employer and you have some personal fights so that they are not cooperate in the EPF withdrawal procedure?

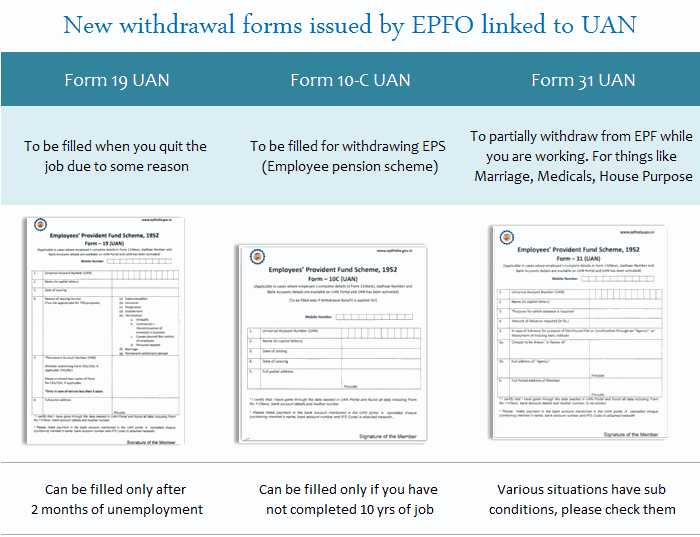

So, Here is a good news for you that EPFO recently launched “New EPF Withdrawal Forms” in February 2017, which are called as Form 19 UAN, Form 10C UAN and Form 31 UAN. Now, it is possible to withdraw EPF without the employer signature.

Before this if you plan to withdraw your EPF balance, the process was too lengthy. However, now the employees, who have their activated UAN(Universal Account Number), may withdraw it by submitting directly to regional EPFO.

But before that you should know the Conditions and Rules to take benefit of this facility.

Rules to be follow before withdrawal Of PF

If you are meeting below four conditions, then without the signature of your employer you can withdraw EPF .

- You must have UAN activated number.

- Your Aadhaar number must be linked with UAN.

- With UAN you must provided your Bank details .

- Using digital signatures your KYC have been verified by your employer .

Steps to withdraw your EPF without Employer Signature

Here are basically three easy steps you need to follow to successfully withdraw your EPF without employer signatures.

- First of all download and fill up Form 19 ,Form 10C and and form 31 for EPS Withdrawal.

- Take attestation by any one of the following

- Manager of a bank (PSU preferred)

- By any gazetted officer.

- Magistrate / Post / Sub Post Master / Notary

- Write down a letter addressing the regional PF commissioner, giving the reason why you have to get it attest and how you are facing issues with your employer. In case you have any proof of supportive behaviour from your employer attach that proof.

EPF Withdrawal if your Aadhaar and Bank not linked

If in case you are not given Aadhaar card or Bank details. So,don’t you worry, you have to fill the regular Form 19, Form 10C or Form 31 and submit it to regional EPFO.If because of some reason your last company not co-operating with you for withdrawal, then in this case you can follow below steps-

- Please fill Form 19 and Form 10C for EPS Withdrawal. “New EPF Withdrawal Forms” is different.

- Take attestation by anyone of the Bank Manage(PSU preferred or where you have a savings account)/gazetted officer/ Magistrate / Post /Notary/ Sub Post Master.

- Write a letter addressing to regional EPFO stating the reason for not getting attestation from an employer.

Along with cancelled cheque, Send this filled form to regional EPFO. - Also, you have to attach a copy of your ID proof and address proof.

New EPF Withdrawal Forms Facilities-

Now , By Using “New EPF Withdrawal Forms”, their is following facilities given-

- Withdraw your EPF or apply for final settlement.

- Withdraw your EPS benefit by using this new form.

- Make a partial withdrawal for loan or advance.

This “New EPF Withdrawal Forms” is very easy you only require your basic details. You have to fill it and directly submit in regional EPFO Office. And for this now you don’t need your employer signature.

New EPF Withdrawal Forms-Form 19 |Form 10C |Form 31

Below is the Sample Forms Of Form 19 ,10-C and Form 31 UAN-

So,Here we go with the Detail Knowledge about what actually the Form 19, 10C and 31 is.

Form 19

If you quit your job then use this form to withdraw EPF amount in case of retirement, resignation, disablement, termination, marriage, or permanent settlement abroad. The some conditions for submitting form 19 are-.

- If you are discharge from the service on receiving the compensation under the Industrial Dispute Act, 1947 or resigned from the job, but not employed in a company where EPFO not applicable, then you have to apply for EPF withdrawal only after two months of waiting period. Along with that, under any organization where you are having another EPF Account, you have to declare about your non-employment.

- As in the case you started to work on new company again where the employer falls under EPFO act, then you have to submit for your TRANSFER.

Form 10C

Use this form to claim the EPS amount (Employee Pension Scheme) along with Form 19 (UAN). However, there are certain conditions to use this form and are explain below.

- If you leave your job before completion of 10 years of service.

- You have attained the age of 58 years before completion of 10 years of service whether in service or left the service.

- Either you have completed 10 years of service but not the age of 50 years on the date of filling this form.

- You attained the age of 50 years, but not 58 years and not willing to go for reduced pension.

- You have not completed 10 years of eligible service and nominee of the employee who died after 58 years age.

Form 31

Use this form to avail advances or withdrawal. This advance facility is specifically designed in such a way that employee’s major needs like buying property, renovation of property, health issues or marriage and education of kids are easily meet with advancing from their EPF. One may not get the full expenses by advancing from EPF but it certainly helps employees in case of emergency.

So, I hope this article helps you to clear your doubt on “How To Withdraw PF Amount Without Any Employer Signature?”.If still you have any concern please fill free to ask in the comments section below. You can also press star on top and bookmark this page.

April 17, 2017 11:00 am

so online pf withdrawal is not possible and why we need of attestation by gazetted officer

December 10, 2017 1:28 pm

i have no username and password in uan so how im open my id in uan

March 1, 2018 9:23 am

if my balance is less than 50000 and my service is less than 5 year….TDS wil be imposed or not..??