For EPF account holders, the Universal Account Number (UAN) is crucial since the whole Employee Provident Fund (EPF) services procedure is now conducted online. UAN makes it simple to use your PF account services, including…

For EPF account holders, the Universal Account Number (UAN) is crucial since the whole Employee Provident Fund (EPF) services procedure is now conducted online. UAN makes it simple to use your PF account services, including…

Employees’ Provident Fund objectives include enhancing social welfare and giving the Indian workers financial stability. Below we have discussed the entire process for employers on how to register for the EPF. What is EPF? The…

The long-term investment schemes for retirement are the Employee Provident Provident Fund (EPF) and the Public Provident Fund (PPF). Owing to their calm, safe, and slow attitude, they’re considered safe. Here, you may continue to…

The Employees Provident Fund (EPF) is a program that allows for the collection of retirement benefits. Learn how much your company contributes to your EPF by reading this article. What is the Employees’ Provident Fund?…

This article covers everything about Form 10C – how to claim Withdrawal Benefit or Scheme Certificate, who can claim them, and how to fill the form. [toc] What is Form 10C? It is the form…

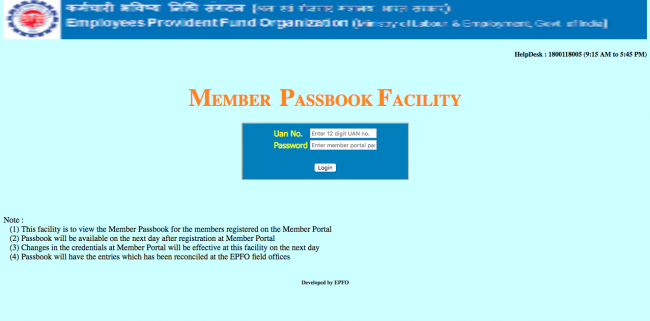

[toc] Unable download EPF UAN passbook – UAN Helpdesk? EPFO has moved its portal after February 2017 to a new Unified Provident Fund portal. Due to the transaction, you might face few difficulties on operating in the…

The Employees Provident Fund Organisation (EPFO) has introduced a new feature called member passbook. It will keep track of all your transactions made towards a provident fund over the years. You can download your EPF…

Provident fund (PF) or Employee Provident Fund (EPF) is a major mandatory savings scheme by the government. According to this, every government or private employees’ must contribute some part (usually 12% of your basic salary)…

Employees Provident Fund (EPF), Public Provident Fund (PPF), Voluntary Provident Fund (VPF), and National Pension Scheme (NPS) are very popular for retirement savings because of their numerous features like low risk and tax benefits. However, being…

Are you facing the problem to withdraw EPF amount.Do you want to withdraw your EPF without any employer signature? Is your previous employer not signing your EPF withdrawal documents? Have you left your jobs and your unable…