Have you ever come across certain banking terminology that you were unable to fathom? There might be a lot of words or acronyms that might be difficult for people to understand instantly. One such acronym could be PPF account. Let us understand what PPF is, and how to open its account in SBI, HDFC, ICICI, AXIS Bank.

[toc]

What exactly is PPF?

- Public Provident Fund (PPF) Scheme comes under the PPF Act of 1968, and was initiated by the Ministry of Finance (MoF).

- It basically is a tax-free savings account, and the interest received on deposits in this account is not taxable.

- Any deposits that are made to PPF accounts can be declared as tax deductions.

- PPF accounts are beneficial for the user as they target retirement security, and also prove to be useful to save money for weddings or to purchase the property. Therefore, customers prefer opening a PPF account to any other account if they want to enjoy long-term savings.

- This makes the PPF Scheme one of the most tax-efficient instruments in the country.

- A Public Provident Fund (PPF) account matures after the completion of 15 years from the end of the year in which the account was opened. You can then extend it in blocks of 5 years, if so desired.

Who is eligible to open a PPF account in SBI, HDFC, ICICI, AXIS bank?

- Only those individuals who are residents of India can open accounts under the PPF scheme.

- Moreover, a person can open only one PPF account, a minor’s account is an exception in this case.

- Both the mother and father cannot open an account on behalf of the same minor.

- Also, Non-Resident Indians (NRIs) are not eligible to open this account.

- You cannot have joint PPF accounts.

What are the documents required to open a PPF account in SBI, HDFC, ICICI, AXIS Bank?

An individual needs to have certain documents in order to open a PPF account in the bank. The forms and documents required are:

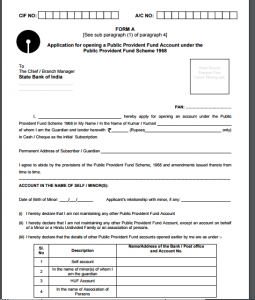

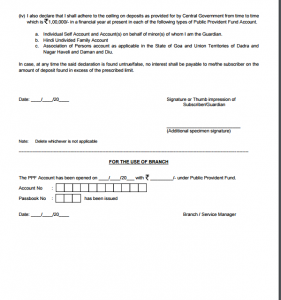

- PPF Account Opening Form (Form A)

- Two passport size photographs

- Copy of PAN card (or form 60-61 in case of absence of PAN card)

- Residence proof – Passport / Electricity Bill

- Age proof (in case of minor)

- PPF Nomination form (if you are naming a nominee)

These are the general documents required, but the list may vary with respect to the banks.

How to open a PPF account in SBI, HDFC, ICICI, AXIS Bank?

To open a PPF account in SBI, HDFC, ICICI, AXIS Bank follow these steps:

- Only select SBI, HDFC, ICICI, AXIS Bank branches can open PPF accounts.

- You can find the list of branches that open PPF accounts from any SBI, HDFC, ICICI, AXIS Bank branch, or by calling their Customer Care number.

- So find the nearest branch that opens PPF accounts.

- Collect a PPF Form A from the selected bank branch.

- You can visit the branch, and fill the FORM A provided by the bank.

- In case you’re having a problem identifying the application form, kindly refer to the images below.

- Thus, once you have the required documents, and have filled the necessary details along with the fees, you can submit your form.

- After the bank reviews it, it will issue your PPF account passbook, and you will have access to your PPF account.

- You can open an account for Rs.100, but you have to deposit a total of minimum of Rs.500 per year.

- You can make deposits in your PPF account by transferring funds online, or by making cash deposits.

- To read about PPF withdrawal rules, please click here.

What is the rate of interest offered on PPF accounts in SBI, HDFC, ICICI, AXIS Bank?

The Government of India regularly updates and announces the rate of interest offered on PPF account deposits. The current PPF interest rate, starting from 1st April 2017, is 7.90%. Using a PPF calculator, you can determine the maturity amount.

For any more details, check out the official HDFC Bank website.

The process for opening a PPF account in SBI is very similar.

Press star on top to bookmark this page, and comment below if you have any questions.

List of banks that offer PPF Services

| Allahabad Bank |

| State Bank of Jaipur |

| Corporation Bank |

| ICICI Bank |

| IOB – Indian Overseas Bank |

| State Bank of Patiala |

| PNB – Punjab National Bank |

| Central Bank of India |

| Axis Bank |

| United Bank of India |

| Bank of Maharashtra |

| BOI – Bank of India |

| State Bank of Travancore |

| State Bank of India or SBI |

| Vijaya Bank |

| IDBI |

| State Bank of Hyderabad |

| State Bank of Mysore |

| Canara Bank |

| Union Bank of India |

| Oriental Bank of Commerce |

| Indian Bank |

| BOB – Bank of Baroda |

| State Bank of Bikaner |

| Dena Bank |

Leave a Reply