The CIF number of the account may be checked in a variety of ways through the State Bank of India. For those who don’t know, each bank client has a unique Customer Information File number that is used to record account information, including KYC information, digitally. It is a file that the bank system has on hand. Continue reading to know how to check the CIF Number in SBI.

What is CIF Number in SBI?

All of the account holder’s demographic data is kept in a file called CIF. Each Customer Information File file has its own individual CIF number. With more than 24000 branches in India alone and 190 offices in 35 other nations, SBI is the dominant bank in the Indian banking industry. The Customer Information File Number is another name for the CIF code.

The numbers on the Customer Information File are known as CIF Numbers. A computerized file including all of the personal and account-related data for the bank’s customers is linked to this one-of-a-kind number. An 11-digit number serves as the representative for the digital file, commonly known as CIF. The loans and Demat accounts of the consumer are detailed in this file. Additionally, it includes his KYC data, including his residence, identity details, and supporting documentation including a photo ID.

How can you find your Customer Information File Number?

CIF is a crucial number for State Bank of India clients, and it is written in their passbook or on the first page of their checkbook when they open an account. It is an 11-digit number. Customer Information File holds all of an account holder’s vital information in digital form. A CIF number is a unique identifying number assigned to each CIF. It is used to get all of the customer’s information throughout the verification process.

How can I get the CIF Number of SBI by SMS?

You must first link your bank account to your email address. You may quickly submit an e-statement request by SMS. Your Customer Information File number may be found on your e-statement. Send an SMS from your registered cellphone number to obtain the e-statement. When you receive an e-statement, just view the PDF file to discover your CIF number. Though there is currently no direct way to send an SMS and obtain your Customer Information File number.

How to find the CIF Number in SBI without a passbook?

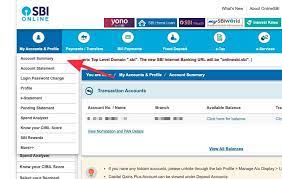

If you have SBI Internet Banking, you may log in and see your CIF number by following the easy procedures outlined below:

- Log in to SBI’s net banking site.

- Select the ‘My Account and Profile’ option.

- Navigate to ‘account summary.’

- Select ‘View Nomination and PAN’ from the drop-down menu.

- The Customer Information File number is seen on the following screen.

- Another approach to finding out is to look at the account statement summary. Choose the account number and account statement period. Then press the Submit button. The CIF number will appear on the account statement.

CIF from SBI Yono Lite

- Launch the SBI Yono App and sign in with your account credentials.

- Select the Services tab.

- On the next screen, click Online Nomination.

- Change the account type to “transaction account”

- At last, your CIF number will appear on your account statement.

CIF via Customer Care

If you are unsure about using the website or app, you can call customer service to obtain the CIF number.

- Call any of the toll-free lines: 1800 425 3800, 1800 11 2211, 080-26599990

- Choose the language in which you wish to communicate with the customer service agent.

- Request that they submit their CIF number.

- Answer a few questions to confirm your identity.

- Finally, after verification, the customer service agent will offer the CIF number.

Is Customer Information File confidential?

When asked about your CIF number, it is safe to provide it. In reality, it is frequently used to authenticate your identity. Your CIF number is a specifically coded number that helps the bank monitor client information and has no bearing on money transactions. The CIF number functions as an index reference and is an essential component of the banking system. However, it is only beneficial within the bank, where personnel may access their client database to obtain a financial summary for a customer. Otherwise, the Customer Information File number is merely a collection of digits that have no value on their own and are useless to anybody else.

Leave a Reply