Drawer : The person who signs the cheque and orders the payment is referred as the drawer

Payee : The person to whom the cheque amount shall be paid.

Drawee : The bank acts as an intermediate between drawer and payee. It is called the drawee.

[toc]

What is a crossed cheque?

You might have noticed two slanted parallel lines at the left upper corner of the cheque. This means the payee is not authorized to encash the cheque directly in the bank or any other credited institution but can credit the amount to his bank account. This adds a security to the cheque and must be followed by everyone.

When there are no crossed lines on the cheque it is called as an open cheque. Open cheques can be encashed at the counter itself. No restrictions apply for open cheques.

Significance of Crossed cheque

Also, crossed cheque has one another significance. Once a cheque leaf is crossed, the payee can further the cheque. Thus the payee can either credit the amount of the cheque or endorse it. This is done by writing the name of the person with the payee signature behind the cheque. Hence, someone else can credit the amount or further endorse the cheque.

For example, someone has drafted a crossed cheque to me. I have two options.

- Encash the cheque by submitting it to the drawee.

- Further the cheque.

So, I can write Mr. XYZ behind the cheque with my signature to endorse the cheque. Mr. XYZ can either credit the amount in his account of furthermore endorse the cheque to Mr. ABC. This means there is no restriction on who can endorse the cheque.

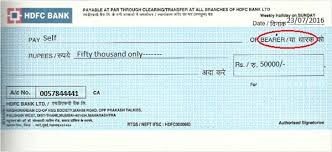

Difference between crossed cheques and bearer cheques

As the word infers, when the words “or bearer” is not stricken from the cheque. In the case of bearer cheque, the bank can encash the cheque in favor of the person who presents the cheque. Crossed cheque cannot be encashed.

Types of crossed cheques

There are 2 types of crossing which can instruct the bank to act accordingly with the amount of the cheque.

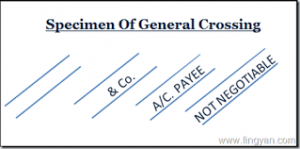

General crossing

This is the most general type of crossing where the drawer simply puts two parallel lines at the upper left corner of the cheque. Crossed cheques amount can only be deposited in the payee account’s bank so that it can be traced anytime. You cannot encash a crossed cheque over the counter.

Restrictive or special crossed cheque

Special crossed cheque is where you write a set of instruction in between the crossings. For example “A/C payee only” or “State bank of India”. In such cases, the drawee can pay on in the account of the payee or can only credit the amount through State Bank of India (SBI must act as the drawee).

People also write “& co.” in between the lines. However, it is not compulsory to write so. This will instruct the bank whom to pay the amount of the cheque.

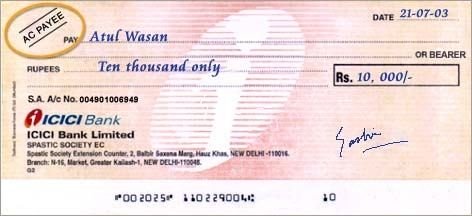

Account payee cheques

This type of crossed cheque increases the security on the cheque. For this type of crossed cheque, you must write “A/c payee only” in between the crossed lines. The payee cannot endorse the cheque. Thus, the cheque amount can only be deposited in the payee account. Thus, it protects the misuse of the cheque. It is a good practice to write cheques as such.

For example, if the cheque is in my favor (I am the payee), the amount mentioned in the cheque can be deposited to only my account. I cannot further endorse the cheque to any third party.

A banker collecting an account payee cheque from a person other than the payee is liable. Also, account payee cheque is valid for only 3 months.

How to fill a cheque for self-withdrawal?

Many cases the drawer and payee are the people. This happens when you are withdrawing a certain amount from your own account. This is called self-cheque. To write a self-cheque, fill the details like any other cheque. In the row of “Pay to the Order Of,” write your full name. You can also clearly write the word “SELF” as an alternate to your name.

So, make sure you use the correct crossing on your cheque to avoid mishandling of the cheque.

Leave a Reply