Pradhan Mantri Awas Yojana (the PMAY scheme)- An initiative taken by Prime Minister of India, Narendra Modi through which housing will be provided to the poor.

It was launched in 2015 in which construction of 2 crore houses was proposed by the year 2022. This scheme included low-income groups and economically weaker sections along with the four sub-sections-

- Slum Redevelopment with the participation of private sector.

- Affordable Housing in private and public sector partnerships.

- Beneficiary House construction.

- Affordable Housing through Credit Linked Subsidy Scheme.

The recently introduced scheme is CLSS that is only applicable for the people in MIG’s. It will be only for a one-year period that starts from 01.01.2017.

The MIG Eligibility

The MIG Group comprises of the following slabs-

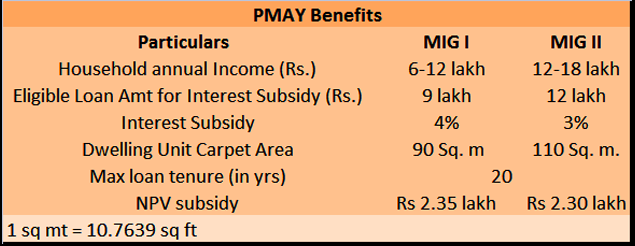

The MIG-1 group consists of the households that have their income between Rs. 6,00,001 to Rs. 12,00,000.

The MIG-2 consists of the households that have an annual income between Rs. 12,00,001 up to Rs. 18,00,000.

Eligibility For The Scheme

The rule for PMAY says- “The beneficiary family should not own a pucca house and the beneficiary family should not have availed of assistance under any housing scheme from Government of India.”

The family of the beneficiary should comprise of wife, husband, unmarried sons or daughters. And, to avoid the duplication, family members have to provide Aadhar card when applying for the loan.

As per the guidelines-

- An adult earning is a separate household and he/she should not have a house in any part of the India.

- For the ones who are married, they will be eligible for one house that will be either of the spouses; or can be bought in a joint membership.

Pradhan Mantri Awas Yojana Subsidy

- For the MIG-1 category, an individual gets 4% of the subsidy on loan up to 9 lakhs.

- For the MIG-2 category, an individual gets 3% of the subsidy on loan up to 12 lakhs.

If you need an additional loan, you will start getting the loans at a rate with no subsidies.

How To Do The Subsidy Adjustment?

The interest of the subsidy amount is not the differential of actual subsidy rate but will be the NPV for the interest subsidy. The subsidy is calculated at a discount of 9%. The interest subsidy gets into the loan account that results in an effective housing loan and EMI while the borrower will then pay the EMI as per the rates on the remaining loan amount.

Home Area Under PMAY

For MIG-1, the carpet area is 90 sq mt while for MIG-2 it is 110 sq mt. This area does not contain the thickness for inner walls and if you add some area, it becomes built up area. A 110 sq mt area is quite close to 1480 sq ft of the “built up area” and a 2 BHK could look feasible in various locations. It has made the scheme accessible to all and many people have started living in urban areas now.

Subsidized Loans From Where

An individual can get PMAY loan from a primary lending institution that includes Urban Co-operative Banks, State Bank, and Scheduled Commercial Banks. Small Finance Bank and Non-Banking Financial Company also offer the Pradhan Mantri Awas Yojana subsidy loans. There is no processing charge and for additional loans, the lender will charge a nominal fee.

Conclusion

Read all the sections carefully before you apply for this scheme. If you are a first- time buyer, evaluate every point before you go out got an affordable housing segment.

August 28, 2018 7:57 pm

I bought a flat and it is under construction;The delivery date is Nov 2018. Can I apply PMAY? Is there any mandatory to apply only after completion?