The Public Provident Fund (PPF) is a tax-free, long-term savings scheme initiated by the government. It was initiated by the government to encourage savings among people. Also, such that post-retirement, people do not struggle financially. You can deposit your savings in the PPF account and get attractive returns on it. The government has also laid down clear PPF withdrawal rules.

A PPF account accumulates a regular interest on the deposited amount. The PPF interest rate is regularly revised and updated by the government.The current rate of interest for the financial year 2016-17 is 8.1%. By using a PPF calculator, you can determine the maturity amount. You can read about the comparative benefits of PPF as a saving scheme over here.

You can open your provident fund accounts in your private banks as well. The minimum yearly amount one can deposit is INR 500 and the maximum yearly amount is INR 1,50,000. You can make 12 installments per year.

PPF Withdrawal rules

- Firstly, you can withdraw the full amount only after 15 years (post-maturity). A lot of people mix up the year with financial year and have their counting wrong. Let’s give you an example. If you opened the account on say 10th August 2015 then it will not mature on 10th August 2030 (15 years) but on 1st April 2031. Because the 15 years count starts from 1st April 2016. This is because financial year is from April to March.

- In the case of emergency, like child’s education, marriage, medical issue, you can claim for a partial withdrawal.

- Next, a person cannot close the account prematurely unless the applicant met with death.

- You can know your PPF withdrawal status by internet banking. For all accounts linked to the post office, you should file a request to know your PPF withdrawal status in your registered branch.

PPF Partial withdrawal rules

- You can claim for a partial withdrawal only after a 7th financial year from when your account is created. This means if you made your account in February 2012, you can only withdraw after 1st April 2017.

- Only one partial withdrawal is allowed every financial year after 7th financial year.

- You can withdraw 50% of the amount saved until the end of the third year. The other option is you can withdraw 50% of the amount saved at the end of the sixth year.

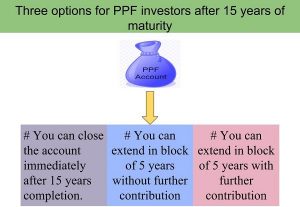

After your PPF account is 15 years old i.e. it reaches maturity, you have three options

Close the account

- Firstly, you can withdraw the complete PPF balance amount in your account and immediately close the account. Also, you will have no further contribution towards the account.

- You can also opt for withdrawing the complete amount in installments. But this lasts for only a year. For example, if your account matured on 1st April 2016, then you can withdraw the amount in installments up to 31st March 2017.

- If your account matured but not closed, it will be extended to a block of five more years without a contribution. You will continue to earn the rate of interest on this account without any contribution.

- Moreover, you cannot open a new account unless you close the previous one.

Continue for 5 more years without any contribution

- Firstly, after maturation, you can continue with the same account and opt for not withdrawing any funds. You will continue to earn the rate of interest on this account without any further contribution.

- If you do not close the account after 15 years, this becomes a default option. For example, account opened on 1st April 2016 will mature on 1st April 2021. After that, if not closed account or applied for extension of the account with contribution, then it will again extend for another 5 years without contribution.

- You cannot contribute to this account type for another 5 years after maturing. Also, you can also not change the type of account once this option is selected in the first year.

- You can withdraw the amount whenever you want in these 5 years.

Continue for 5 more years with further contribution

- Firstly, if you want to continue saving even after 15 years, you have to opt for this option. Thus, after 15 years, you must fill form H which is usually available with your private bank or post office.

- You must submit this application before 1 year of maturity of account. For example, if account matured on 1st May 2016, then you must submit your application before 31st March 2017. Otherwise, the second option mentioned above will activate by default.

- Once approved, you can continue to contribute towards the account and earn the rate of interest.

- Finally, if you continue to contribute after maturation without submitting the form, the amount post maturation will not earn any rate of interest or have any tax benefits

PPF withdrawal forms

| Form A | Fill this for opening your PPF account |

| Form B | This is used for depositing fund or repaying loan |

| Form C | This is form for partial withdrawal request |

| Form D | This is form for PPF loan request |

| Form E | Use Form E for adding PPF nominee |

| Form F | Use form F when you want to change nomination for the account |

| Form G | This is used for settling claims i.e. in case of account holder’s death |

| Form H | Form H used for extension of term period after maturity |

Private banks authorized to create PPF accounts are

- SBI and its subsidiaries

- ICICI bank

- Union Bank of India

- IDBI

- Vijaya Bank

- Allahabad Bank

- Oriental Bank of Commerce

- Bank of Maharashtra

- Canara Bank

- Punjab National Bank

- United Bank of India

- Axis Bank

- Indian Overseas Bank

- Indian Bank

- Corporation Bank

- Dena Bank

- Bank of Baroda

- Central Bank of India

You can also read about how to open PPF account in SBI, how to open PPF account in HDFC Bank, and how to transfer PPF account.

Press star on top to bookmark this page, and comment below if you have any questions.

[bctt tweet=”PPF withdrawal rules Before and After Maturity 2017 updated” via=”no”]

January 14, 2018 10:58 am

Hi my PPF Account is now past it’s maturity date and I reside overseas. I have signed the withdrawal form and sent it to my family members in India who have taken it to the Post Office. However the post office officials are saying that the signatures on the form do not match with those on their records and insist that I appear in person to resolve the matter. I have not been to India for more than a decade and have no 0kans of visiting in near future. Is there a process to resolve this issue by way os either an affidavit or other forms of indenties that would be acceptable to the post office without me having to appear in person? Thanks Tarun

May 7, 2018 6:57 pm

Can A person do partial withdrawal of PPF as per eligibility and deposit the same amount next day in same PPF account to take benefit of Tax saving under 80c?