The Employees Provident Fund Organisation (EPFO) has introduced a new feature called member passbook. It will keep track of all your transactions made towards a provident fund over the years. You can download your EPF…

The Employees Provident Fund Organisation (EPFO) has introduced a new feature called member passbook. It will keep track of all your transactions made towards a provident fund over the years. You can download your EPF…

The Public Provident Fund (PPF) is a tax-free, long-term savings scheme initiated by the government. It was initiated by the government to encourage savings among people. Also, such that post-retirement, people do not struggle financially. You…

Provident fund (PF) or Employee Provident Fund (EPF) is a major mandatory savings scheme by the government. According to this, every government or private employees’ must contribute some part (usually 12% of your basic salary)…

Have you ever come across certain banking terminology that you were unable to fathom? There might be a lot of words or acronyms that might be difficult for people to understand instantly. One such acronym…

A Public Provident Fund (PPF) account is a safe, long-term investment that offers lots of tax benefits. This article is about PPF Interest rates of 2017-18 & PPF Calculation. The interest earned is tax-free, and deposits made towards…

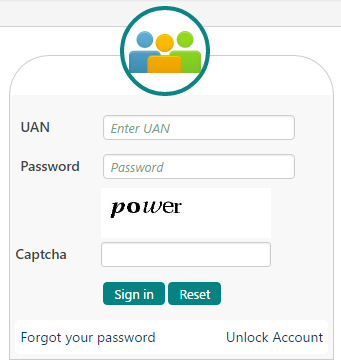

I will tell about How to add/change Phone number, Email Id & update KYC information like Pan Card Adhaar card, Voter id card, Bank details, passport etc in UAN Portal How to change Phone number,…

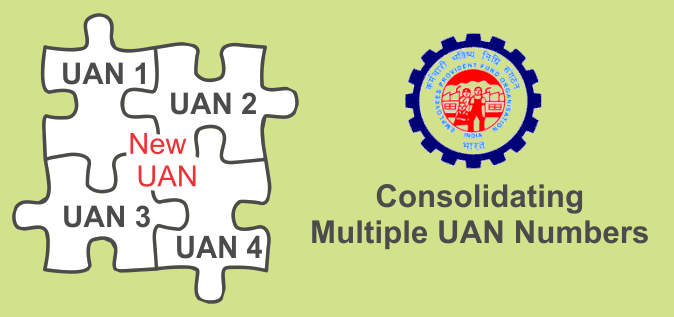

Every employee registered under the Employees Provident Fund (EPF) scheme is given a unique 12 digit number called UAN (Universal Account Number) by the Employees Provident Fund Organisation (EPFO). All PF accounts of an individual are unified under one…

Employees Provident Fund (EPF), Public Provident Fund (PPF), Voluntary Provident Fund (VPF), and National Pension Scheme (NPS) are very popular for retirement savings because of their numerous features like low risk and tax benefits. However, being…

Are you facing the problem to withdraw EPF amount.Do you want to withdraw your EPF without any employer signature? Is your previous employer not signing your EPF withdrawal documents? Have you left your jobs and your unable…

One Of the biggest mistake happen while filling the form that the detail we put sometimes it is not correct.same can happen in EPF forms also and because of that we are unable to check…