Form 12BB is an important form for salaried employees to save tax. This article explains everything about it. [toc] Who should submit Form 12BB? Salaried employees who want to claim tax deductions from TDS on…

Form 12BB is an important form for salaried employees to save tax. This article explains everything about it. [toc] Who should submit Form 12BB? Salaried employees who want to claim tax deductions from TDS on…

This article explains the use of Form 15G and Form 15H, the difference between the two, eligibility, and how to submit them. [toc] Form 15G and Form 15H: what exactly are these? The basic purpose…

Want to find out how to get an income tax refund? This article explains all the basics of getting an income tax refund: the meaning, the procedure to claim a refund, how to check the…

Both private sector employees, as well as government employees, are eligible to receive the gratuity. The gratuity amount is tax-free if it is given according to the formula prescribed by Payment of Gratuity Act, 1971.…

New Income Tax Return Forms AY 2017-18 are notified by Central Board of Direct Taxes (CBDT). To make ITR filing easy some changes are made in the ITR forms, the format, however, is similar to the…

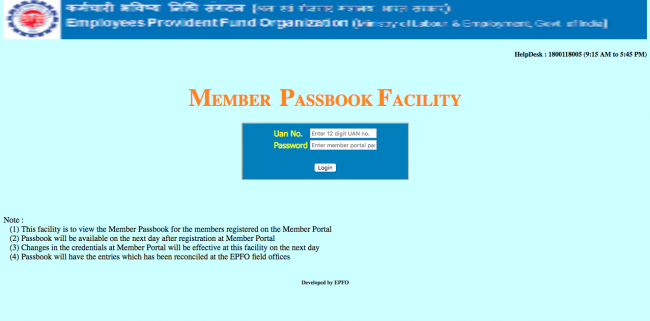

[toc] What is UAN activation link? The UAN activation will act as a joining point for the multiple Member Ids allotted to an individual by different establishments. The idea is to link multiple Member Identification Numbers…

Gifting somebody is a common norm followed since prehistoric ages. Till date, gifting is considered a healthy and courteous habit. It is a way of expressing your gratitude. In this article, we will talk about…

People are always trying to save a little on tax. There are numerous ways to do that. Many tax saving instruments and exceptions are provided by the government. While some options are very well known,…

NATIONAL PENSION SYSTEM (NPS) was set in motion on 1st January 2004, with the purpose of providing retirement income to all the citizens. It is cost-efficient, compliant, convenient and hassle free. NPS strives to plant pension reforms and…

[toc] Unable download EPF UAN passbook – UAN Helpdesk? EPFO has moved its portal after February 2017 to a new Unified Provident Fund portal. Due to the transaction, you might face few difficulties on operating in the…