The two most common types of bank accounts are Savings Account and Current Account. One must select which account to open in a bank depending on the purpose and features of the account. In this article, we will first discuss the basics of these accounts. We will then compare them to understand the difference between Savings Account and Current Account.

[toc]

What is Savings Account?

A Savings Account is the most basic type of bank account. It is suitable for small savings, and money for day to day transactions. This account gives interest and hence helps your money grow. It is suitable for all individuals, salaried people, and students.

What is Current Account?

A Current Account is essentially for businesses and business transactions. It is not for saving or investment purposes.

Savings Account v/s Current Account

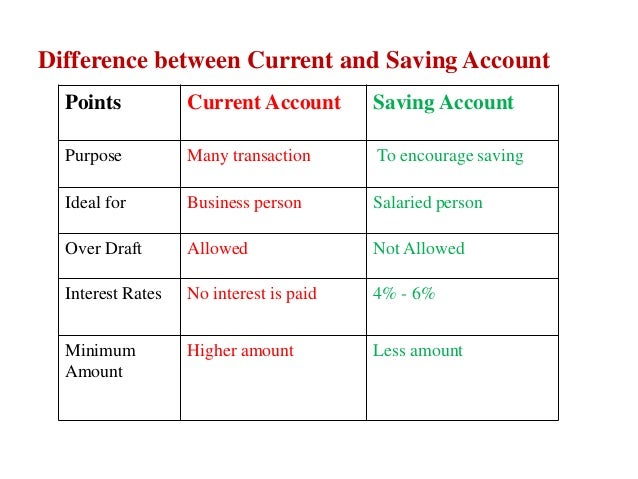

Purpose

Savings Account: They are for saving and keeping funds for day to day transactions.

Current Account: They are for current business transactions only.

Used By

Savings Account: They are used by individuals (can be held singly or jointly).

Current Account: They are held in the name of businesses like companies, partnerships, trusts, etc. They can also be in the name of individuals running sole proprietorships or businesses in their own name.

Maturity or End Date

Savings Account: These accounts do not have any maturity or end date.

Current Account: These accounts do not have any maturity or end date.

Interest

Savings Account: They give interest on money deposited. The interest rates vary with different banks.

Current Account: They don’t give any interest.

Number of Free Transactions

Savings Account:

- The bank allows a limited number of free transactions.

- This number varies with different banks.

- After the number of free transactions is exhausted, the bank usually charges a small fee per transaction.

Current Account:

- Current Accounts do not have limits on transactions.

- This is because they are primarily for business transactions, and also because they don’t give interest.

- However, most private banks charge a fee for transactions over a certain limit for some accounts.

Minimum Balance Requirement

Savings Account:

- Usually banks have a minimum balance requirement for Savings Accounts.

- Penalties are levied for non-adherence.

- The amount of the minimum balance, as well as the penalties levied vary as per the bank.

Current Account:

- Current Accounts also have a minimum balance requirement.

- However, this is usually much higher than Savings Accounts.

- While some public sector banks require a minimum balance starting from Rs.1000, some private sector banks require Rs.25,000 to Rs.75,000 as quarterly balance.

Cheque-book Facility

Savings Account: It is available.

Current Account: It is available.

Overdraft Facility

Savings Account: It is not available.

Current Account: It is available. The maximum limit depends on the account and the bank.

Hopefully this has helped you understand the difference between Savings Account and Current Account.

You can read about opening a Savings, Current, or Salary Account in HDFC bank by clicking here. And to read about the best banks in India to open your salary account with click here.

Leave a Reply