In this article, we will discuss the meaning of cheque bounce, Reasons for cheque bounce, Penalty & Punishments for cheque bounce and Case Time.

[toc]

What is the meaning of cheque bounce?

A cheque is issued to make a payment between two parties, Namely- The drawer(who writes the cheque) and The payee(who is to receive the payment). If due to any reason an obstruction of the payment occurs, it is counted as a dishonoring of that payment. A bounced cheque or a dishonored cheque is when the bank of the payer refuses to make the payment to the payee.

What are the reasons for cheque bounce?

- Insufficient funds in the account of the drawer.

- Mismatch in the signature.

- Crossing limit of overdraft (OD).

- Mismatch in the account number.

- The words and figures mentioned on the cheque don’t match.

- Overwriting in the cheque or omissions/deletions without authentication.

- An expired validity of the cheque.

- Post dated cheque.

- Crossed cheque.

- Missing signatures (A joint account requires both signatures).

- Suspicion of a forged cheque.

- Cheque presented at the wrong branch.

- The account is closed by the drawer.

- Payment stopped from the account by the drawer.

- The cheque does not have the seal of the company(If issued by a company).

- The cheque is issued against the rules of trust.

- The death of the drawer/insanity of the drawer.

Cheque bounce Penalty & Case time.

Once a cheque has bounced, the bank of the payee sends a Cheque Return Memo with reason for the nonpayment to the bank of the drawer. If the payee is confident that the cheque will not bounce again, the cheque can be resubmitted within 3 months. Or the payee can file a legal complaint.The payee is to send a letter (demand notice) within 30 days of the bouncing, to the drawer, threatening to initiate legal proceedings.

(Note: A cheque issued as a gift/donation/any other obligation, is not covered under Section 138 of the Act. Legal action for the bouncing of such is not available.)

If no payment is received after of 15 days of the delivery of the demand notice, the payee can file the legal complaint within a month. Once the court receives the complaint, along with the relevant paper trail, it will issue summons and hear the matter.

(Note: If the Accused does not appear in court on the date of hearing, the court issues a bailable warrant. If he still does not appear before the court, a non-bailable warrant of arrest is issued.)

Punishment for a bounced cheque.

In the Indian penal code, a bounced cheque is a criminal offense.

Section 138 of Negotiable Instruments Act, 1881: A cheque is a negotiable instrument, governed under the clauses of Negotiable Instruments Act too. A criminal liability is established under this section too. Here the drawer of a dishonored cheque may get a jail term of 2 years or fine that may amount up to double the amount of the cheque or both. -source: Indian penal code.

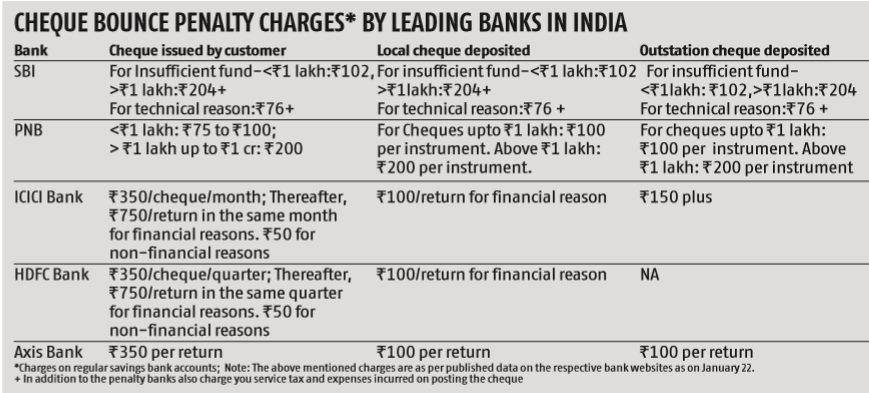

The bank has the right to stop cheque book facility for a particular account. Bank can also close the account for repeat offenses of bounced cheques. The Bank may also charge extra fees/penalty charges to both the drawer and the payee for a bounced cheque for the extra paperwork and time required from the bank.

May 14, 2019 3:59 pm

What is the meaning of cheque bounced for reason No.16- “Drawers authority to operate account not received”