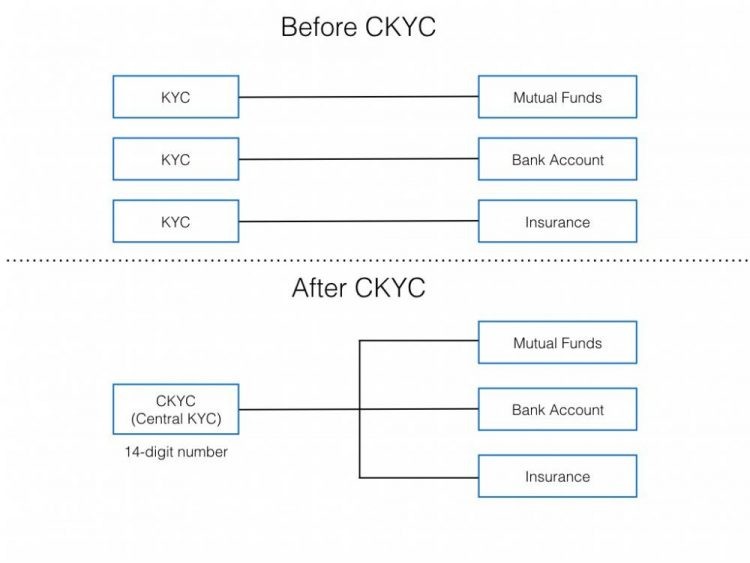

The Government has introduced Central Know Your Customer (CKYC) to make it simpler for customers to deal with different financial entities. Also, by making the process easier, it will encourage more people to invest. Earlier, for tasks like opening a bank account, investing in mutual funds, buying insurance, etc, you had to submit fresh KYC documents every time. Now, you will just have to complete one Central KYC process.

What exactly is Central KYC or CKYC?

- CKYC is simply a centralized KYC process.

- And the CKYC registry is like a centralized storehouse of KYC records of customers. You require these KYC documents for various reasons in the financial sector.

- The CKYC records follow a uniform norm, and hence you can inter-use them for banking, mutual funds, insurance, etc.

Who manages CKYC?

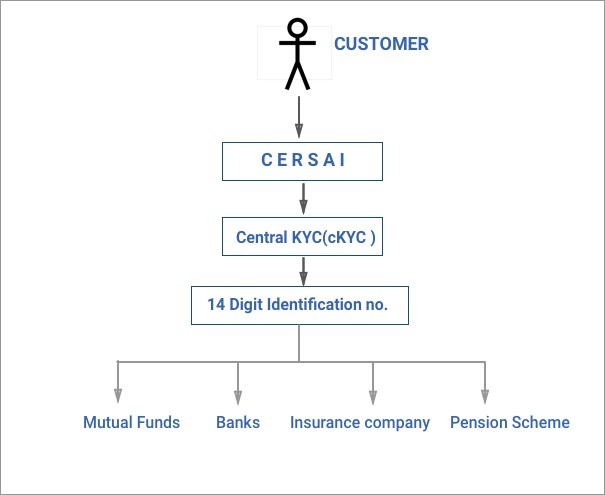

The Government of India has authorized the Central Registry of Securitization Asset Reconstruction and Security Interest (CERSAI) to perform all the functions of CKYC, and act as the CKYC registry.

What is KYC Identification Number (KIN)?

CERSAI allots a unique 14 digit KYC Identification Number (KIN) to an investor on successful completion of CKYC formalities. This number is very important, and you have to mention it whenever CKYC information is required.

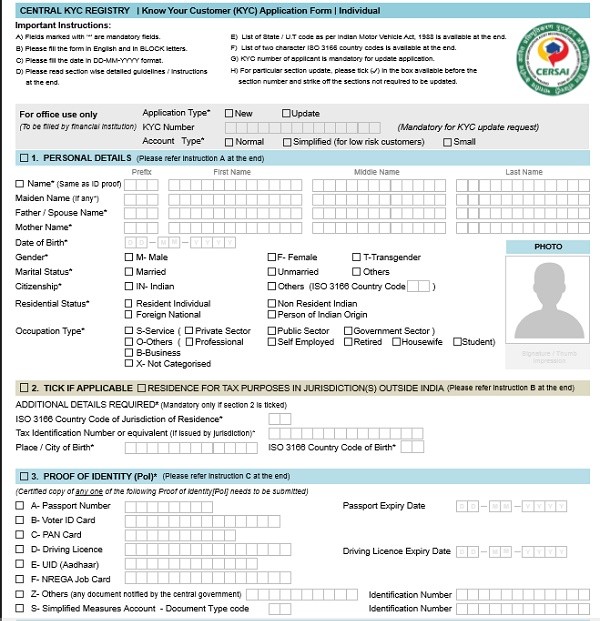

How to complete CKYC?

Please follow the given steps to complete the CKYC process and get your KIN:

- You can get the CKYC form from your bank, insurance company, AMC (Asset Management Company), etc.

- And you can also download it from the AMC or KRA website.

- You can use the same form for both new CKYC application, as well as updating details. You need to tick the appropriate option.

- Fill up the form properly. The additions to the old KYC form are – Aadhaar, date of birth, investor’s maiden name, and mother’s name.

- PAN is not mandatory for CKYC. But it is mandatory for the securities market KYC. So the form for mutual funds, etc, is modified to include PAN.

- The CKYC form also includes FATCA declaration. So fill that up if applicable.

- Submit the duly filled and signed form along with the following –

One photograph,

Proof of identity,

Proof of address – If your permanent address is different from your correspondence address, you have to submit proof of both.

(The copies of the above should be self-attested. Carry the originals for verification at the time of submission.) - After submission, CERSAI will verify the information submitted by you. And then it will generate your unique KIN.

- As soon as your KIN is generated, you will receive an SMS/email on your registered mobile number/email id. You will get the message within 4-5 working days, and it will include your CKYC identifier number.

Notes:

- If you are not a first time investor, and you are KYC compliant, you do not need to take any steps for CKYC.

- Only first-time investors need to do the CKYC formalities. Or if you are not already KYC compliant, you must do this.

- You can do the CKYC formalities at any financial institution regulated by RBI, SEBI, IRDA, or PFRDA.

- Currently, only individual investors of mutual funds (resident Indians and NRIs) have to fulfill KYC requirements according to CKYC norms.

What are the different types of accounts in the CKYC form?

The CKYC form has the following three types of accounts:

- Normal – Customers who don’t fall in the any of the other two categories.

- Simplified (for low risk customers) – Customers who cannot submit any of the six listed documents – Passport, Voter ID, PAN card, Aadhaar card, Driving License, NREGA job card.

- Small – Customers whose aggregate of all credits in a financial year don’t exceed Rs.1,00,000, aggregate of all transfers and withdrawals in a month don’t exceed Rs.10,000, or the balance at any point of time doesn’t exceed Rs.50,000.

Can you check the CKYC status online?

As of now, you cannot check the CKYC status online. There is no link on the official website.

However, Karvy offers the option to check CKYC status by entering PAN.

Hopefully this article will help you understand all about CKYC, and how it will make things much simpler for customers!

Leave a Reply